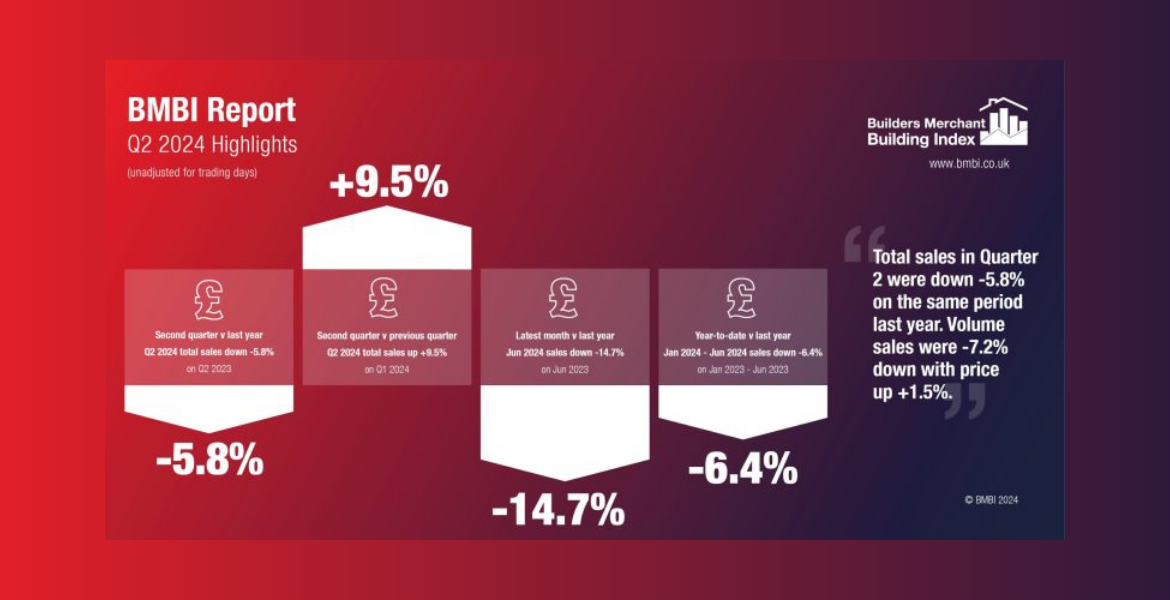

The latest Builders Merchant Building Index (BMBI) report reveals builders’ merchants’ value sales for Q2 2024 were down -5.8% compared to Q2 2023, with volume sales down -7.2% and prices up +1.5%. With two extra trading days this year, like-for-like sales (which take the number of trading days into account) were -8.8% lower.

Half of the twelve categories sold more in Q2 2024, with Workwear & Safetywear up +15.6%, but the two largest categories – Timber & Joinery Products (-7.4%) and Heavy Building Materials (-8.4%) – were both down more than total merchants. Renewables & Water Saving (-28.5%) was the weakest category.

Quarter 2 total value sales were impacted negatively by weak June sales. Total Builders Merchants value sales for June 2024 were down -14.7% compared to the same month in 2023. Volume sales were down -16.9% and prices were up +2.7%. With two less trading days in June this year, like-for-like sales were -6.2% lower. Sales of the three largest categories – Timber & Joinery Products (-15.5%), Landscaping (-16.4%) and Heavy Building Materials (-17.2%) – fell below total merchants.

However, builders’ merchants’ value sales for Q2 2024 were up +9.5% compared to Q1. Volume sales were +13.8% higher, while prices were -3.8% lower. With one less trading day in the most recent period, like-for-like sales were up +11.2%.

Eight of the twelve categories sold more quarter-on-quarter with seasonal category Landscaping (+43.4%) growing strongly. Services (+11.0%) and Heavy Building Materials (+10.3%) increased more than most. Workwear & Safetywear (-9.9%) and Plumbing Heating & Electrical (-10.6%) were the weakest categories.

Total first half value sales were -6.4% below the same period in 2023. With one more trading day this year, like-for-like sales were down -7.2%.

Mike Rigby, CEO of MRA Research who produce this report, said: “From the Q2 headline year-on-year value sales – down -5.8% compared to Q2 2023 – you’d think it’s a gloomy assessment of the market, after a series of downbeat reports in the first half of 2024. But other recent reports show the economy and construction recovering. It’s just that the pipeline of recovering demand hasn’t yet reached builders’ merchants.

“S&P’s Global Market Intelligence reports July growth in UK construction at its highest level in more than two years against a backdrop of expectation that Labour’s shake-up of planning laws will boost activity. S&P say June’s election-related slowdown in growth was temporary with commercial property, housing and infrastructure expanding strongly in July.

“In Barclays Consumer Spend report, Jack Meaning, Chief UK Economist at Barclays, says: ‘Consumers are seeing their incomes and spending power rise and are becoming more confident in the overall economic outlook.’”

“There was a one-point improvement in GfK’s Consumer Confidence Index in July to -13, up from -30 in July 2023, and there was a further seven-point improvement to -16 in GfK’s Major Purchase Index, up from -32 a year ago. Along with a two-point pickup to -8 in consumers’ Personal Finance Situation in the past 12 months the two measures should translate into an increase in home improvement projects.

“National House Building Council (NHBC) reports new home registrations (+34.0%) and completions (+29.0%) up in Q2 compared to Q1, although new home registrations were still down an eye-watering -23.0% year-on-year.

“However, house prices increased by an annual +2.3% in July, the biggest yearly increase since January according to Halifax. UK inflation was up less than expected, and the Bank of England cut the rate by a quarter of one percent with another cut expected in November.

“It’s a turning point, but we’re not there yet,” Mike confirms.

Set up and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for 88% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is produced each quarter.