The key data reported demonstrates that:

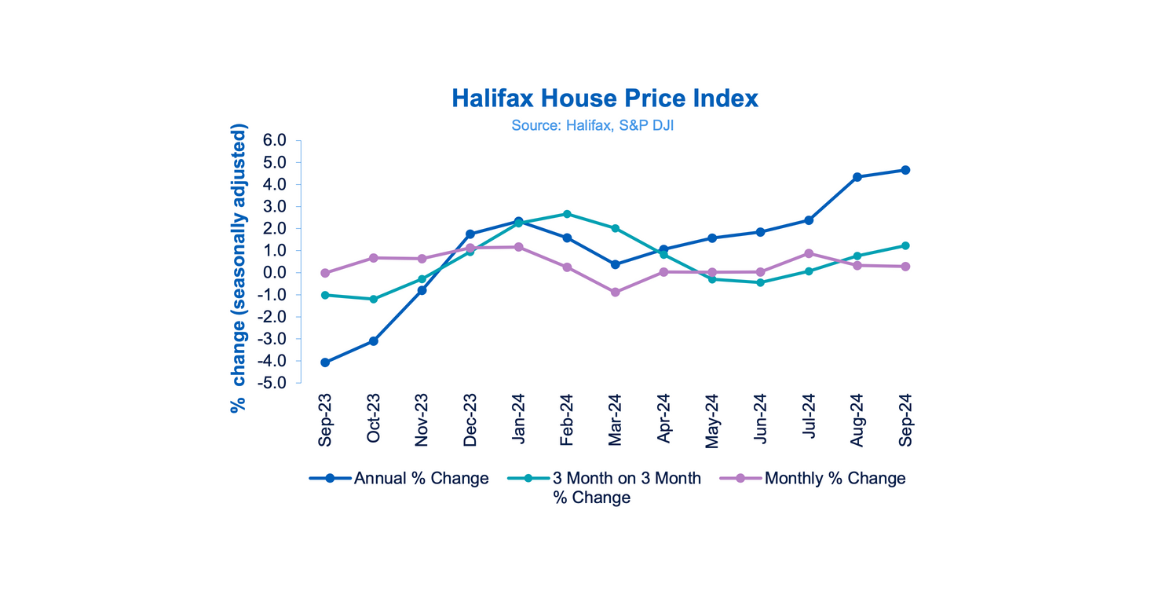

Amanda Bryden, Head of Mortgages at Halifax, says: ‘UK house prices climbed for the third month in a row in September, with a slight increase of +0.3%, or £859 in cash terms. Annual growth edged up to +4.7%, the highest rate since November 2022. This brings the average property price up to £293,399, just shy of the record high of £293,507 set in June 2022.

‘It’s essential to view these recent gains in context. While the typical property value has risen by around £13,000 over the past year, this increase is largely a recovery of the ground lost over the previous 12 months. Looking back two years, prices have increased by just +0.4% (£1,202).

‘Market conditions have steadily improved over the summer and into early autumn. Mortgage affordability has been easing thanks to strong wage growth and falling interest rates. This has boosted confidence among potential buyers, with the number of mortgages agreed up over 40% in the last year and now at their highest level since July 2022.

‘While improved mortgage affordability should continue to support buyer activity – boosted by anticipated further cuts to interest rates – housing costs remain a challenge for many. As a result we expect property price growth over the rest of this year and into next to remain modest.’

View the full report for more insight.